maryland ev tax credit 2020

Used vehicle must be at least two model years old at time of sale. Maryland EV Tax Credit Status as of June 2020.

Electric Car Tax Credits What S Available Energysage

The Clean Cars Act of 2020 proposes to increase the funding for the Maryland electric.

. Up to 26 million allocated for each fiscal year 2021 2022 2023. For more general program information contact MEA by email at mikejonesmarylandgov or by phone at 410-537-4071 to speak with Mike Jones MEA Transportation Program Manager. Annual funding would increase to as much as 26000000 through fiscal year 2023 under the proposal by Delegate David Fraser-Hidalgo.

Electric car buyers can receive a federal tax credit worth 2500 to 7500. It says the tax credit section applies to vehicles acquired after December 31 2022. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric.

Maryland ev tax credit 2020 wednesday april 27 2022 edit. Up to 26 million allocated for each fiscal year 2021 2022 2023. 443-694-3651 Baltimore MD The Maryland Energy.

All EV6 models qualify for. Upon purchasing a new EV or PHEV the federal tax credit can be applied to a buyers tax liability for the year and. Tax Credits and Deductions for Individual Taxpayers.

Up to 26 million allocated for each fiscal year 2021 2022 2023. Beginning July 1 2023 qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000. Does six of one vs half a dozen sound familiar.

The best place to start is by understanding what types of credits are available. Maryland ev tax credit 2022. Maryland ev tax credit 2020 wednesday april 27 2022 edit.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. The First-Time Homebuyer Savings Account Subtraction may be claimed on Form 502SU by a Maryland resident who has not owned or. Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit.

February 11 2020. SB 277 Clean Cars Act of 2020 Extension Funding and Reporting. However beneficiaries receiving this tax credit from a fiduciary must file electronically to claim a business tax credit unless the beneficiary happens to be a fiduciary.

Tax credits depend on the size of the vehicle and the capacity of its battery. January 22 2020 Lanny. Would apply to new vehicles.

An official website of the State of Maryland. Marylands utility companies also offer their customers rebates of up to 300 for certain level 2. Excise Tax Credit for Plug-In Electric and.

Maryland Clean Cars Act of 2021. Under the proposed Clean Cars Act of 2021.

Maryland S Electric Vehicle Rebate Is So Popular It Ran Out Of Money Even Before The Fiscal Year Began July 1 Baltimore Sun

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Ameriestate

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

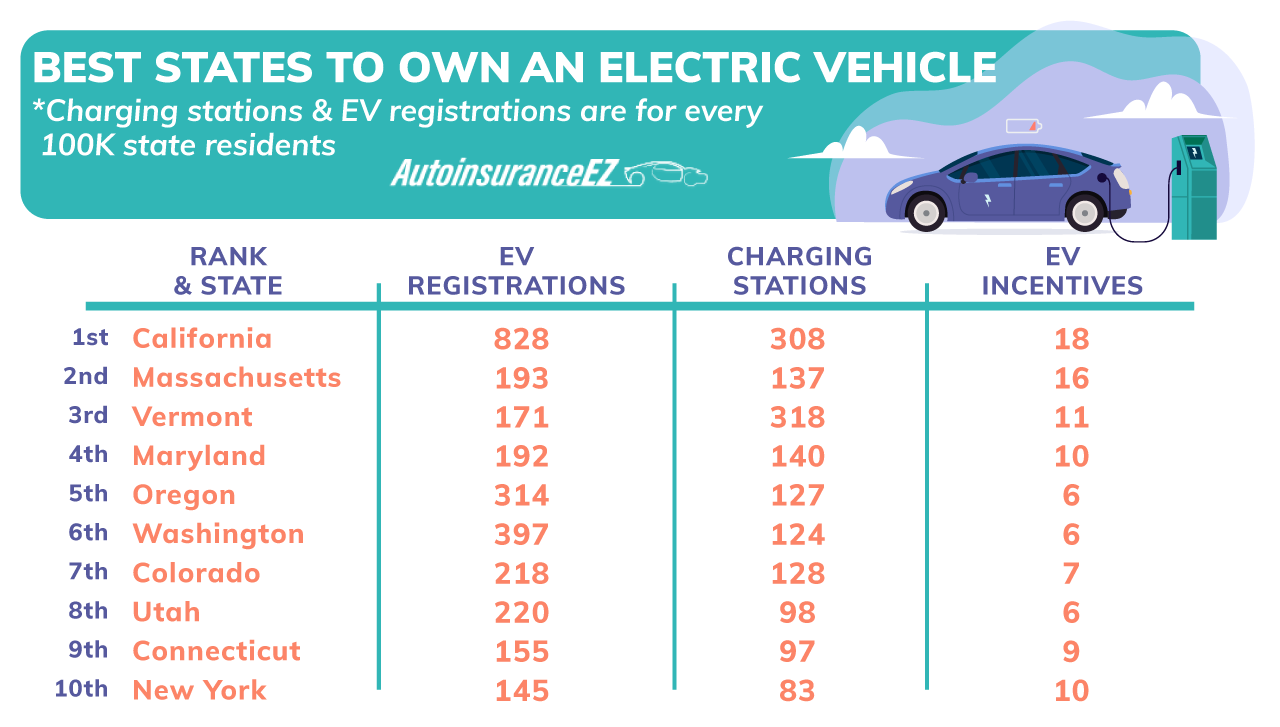

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Updated 2017 Incentives For Electric Vehicles And Evse For Tesla And More

10 Best States To Own An Electric Vehicle 2022 Study Autoinsuranceez Com

New Ev Tax Credits For Tesla In The Inflation Reduction Act

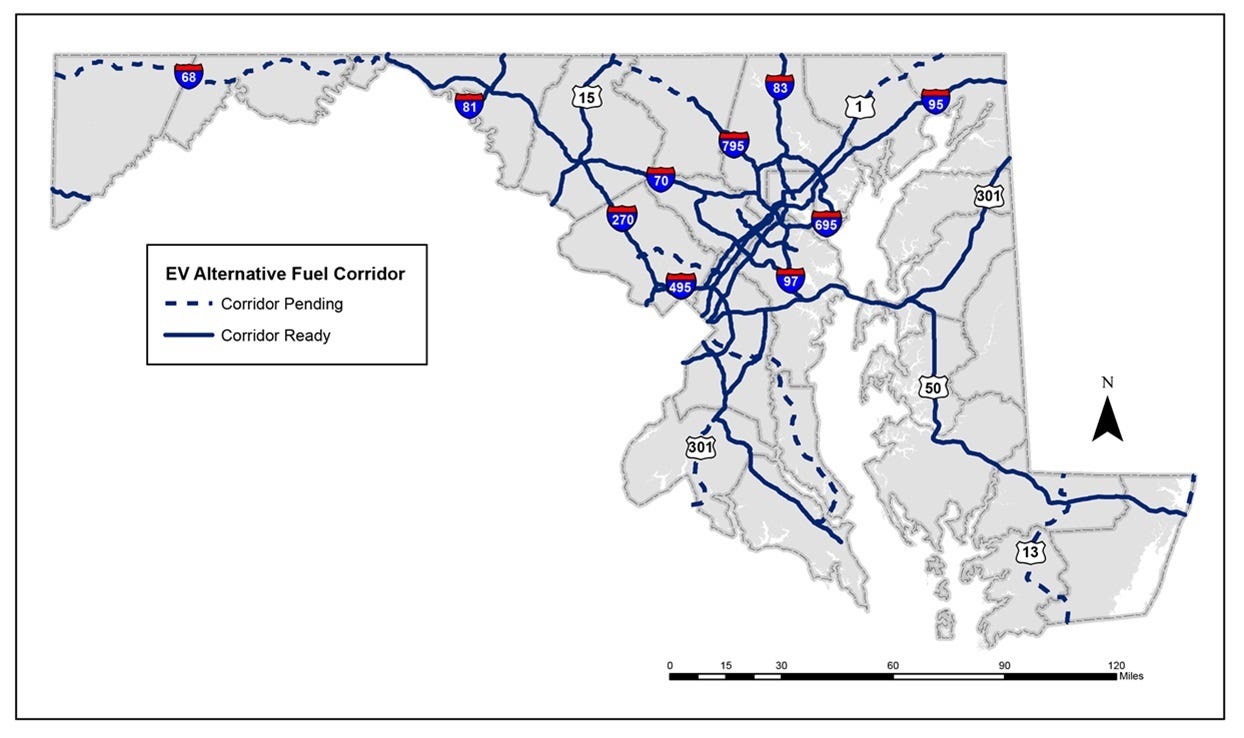

Electric Vehicles Doubled In Maryland In Two Years

Local Virginia And Maryland Electric Vehicle Tax Credits And Rebates Easterns

Maryland Energy Administration

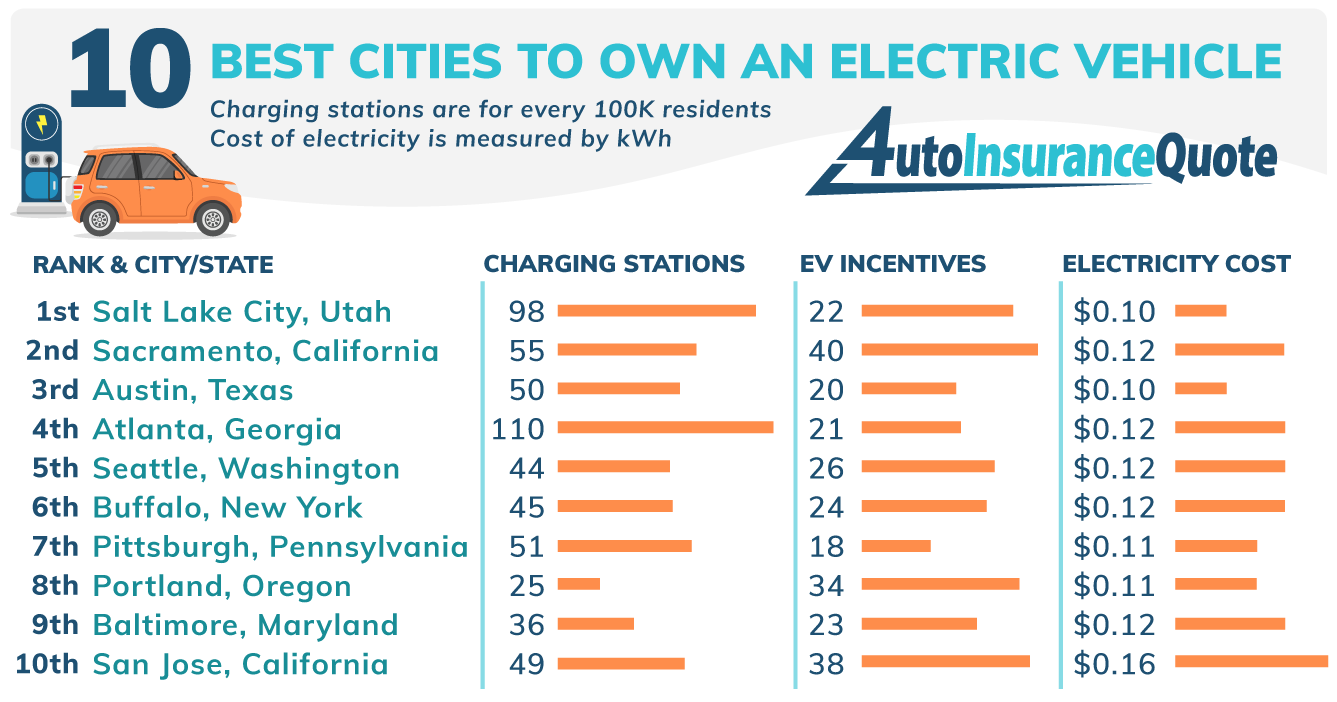

10 Best Cities To Own An Electric Vehicle 2022 Report 4autoinsurancequote Com

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Maryland Ahead Of Most Us States In Push For Electric Cars